How forensic accounting uncover frauds hidden in plain sight

Table of Contents

Forensic Accounting: The Financial Detective Work That Saves Billions

When most people think of detectives, they imagine trench coats, magnifying glasses, and crime scenes. But in the corporate world, there’s another kind of detective — one who hunts for hidden numbers, suspicious transactions, and financial cover-ups. These specialists are forensic accountants — and they might just be the unsung heroes preventing billion-dollar disasters.

What is Forensic Accounting?

Forensic accounting is the use of accounting, auditing, and investigative skills to examine financial records for fraud, mismanagement, or legal disputes. Unlike regular accounting, which focuses on recording transactions, forensic accounting aims to uncover the truth — often before it’s too late.

It’s used in:

- Corporate fraud investigations

- Litigation support

- Insurance claims verification

- Divorce settlements involving large assets

- Bankruptcy and insolvency cases

Think of it as financial CSI — but instead of fingerprints and DNA, the clues are hidden in spreadsheets, ledgers, and emails.

Why It Matters

Corporate fraud isn’t just a big company problem — it’s an everyone problem. When fraud happens, investors lose money, employees lose jobs, and public trust takes a hit.

Early detection can save:

- Shareholder wealth (Wirecard collapse wiped out €24 billion)

- Jobs (Enron’s downfall left 20,000 unemployed)

- Taxpayer money (public sector scams)

Forensic accountants are trained to spot red flags long before they turn into headlines.

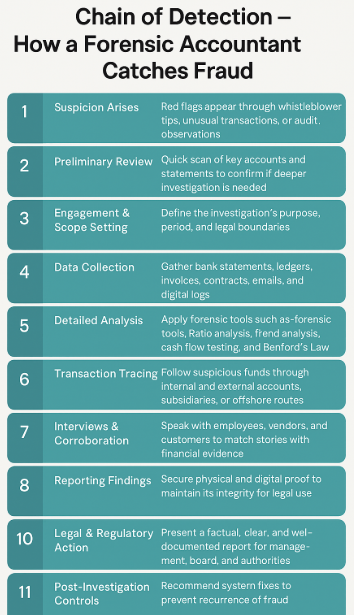

Role of a Forensic Accountant

Fraud Detection – Identifies suspicious transactions, inconsistencies, and patterns in financial data.

Evidence Gathering – Collects and secures financial records that can stand in a court of law.

Data Analysis – Uses tools like ratio analysis, trend analysis, and Benford’s Law to spot anomalies.

Transaction Tracing – Follows the money trail across accounts, subsidiaries, and offshore entities.

Interview & Inquiry – Works with employees, management, and stakeholders to gather facts.

Reporting – Prepares detailed investigation reports for boards, regulators, and legal authorities.

Litigation Support – Assists in legal proceedings by presenting financial evidence and expert testimony.

Prevention & Controls – Recommends improvements in internal controls to avoid future fraud.

Story of SilverShine Capital– A Shine That Hid the Shadows

The tall glass building of SilverShine Capital sparkled in the morning sun. From the outside, it looked like a place where dreams came true — a symbol of wealth, power, and success. Inside, the air buzzed with energy. Phones rang, deals were signed, and big screens flashed numbers that made investors feel safe.

But hidden in those numbers… was a secret no one wanted to see.

The First Whisper of Trouble

It started with something small. A payment to a supplier was delayed — nothing unusual in business. A small mismatch in the accounts — easy to overlook.

But Sakshi, a young accounts assistant, didn’t overlook it. She had a love for details that others found obsessive. While preparing a routine report, she noticed something strange — the company’s debt had shot up by 40% in just three months, even though profits were supposedly rising.

Her colleague brushed it off.

“That’s just creative accounting,” he said with a smile.

But Sakshi’s gut told her otherwise.

When the Numbers Don’t Match

Sakshi compared the profit and loss statement with the cash flow statement.

- The profit report showed booming sales.

- The cash flow report showed… no matching cash coming in.

She visited the warehouse to confirm. The shelves were full — the stock hadn’t moved much. This meant the company was reporting sales without actually selling products — a classic red flag.

The Midnight Entry

Then came the turning point. Sakshi noticed a huge journal entry posted at midnight, credited to a user ID she didn’t recognize. The entry shifted millions between accounts in a way that made the balance sheet look healthier than it actually was.

Sakshi used the company’s Whistleblower Portal, sending an anonymous tip to the Audit Committee — an arm of the board that included Independent Directors

The Independent Directors didn’t ignore the tip. They brought in an external forensic accounting firm within 48 hours.

The team worked like detectives — not in trench coats, but in Excel sheets and data analytics tools:

Summary of Initial Steps Taken

Here is step by step approach:

- Initial Suspicion

- Sakshi, while working in the finance department, noticed numbers that didn’t make sense (e.g., revenue growing but no matching cash inflow).

- Internal Safeguard Step

- She first approached the internal audit head (or compliance officer) — as per whistleblower policy — rather than directly confronting management.

- Escalation to 3rd Party

- The internal audit head realized the anomalies were serious and potentially fraudulent.

- Following company policy, they hired an independent forensic accounting firm under strict confidentiality.

- Why Not Go Public Immediately?

- Jumping directly to regulators without evidence could have exposed Sakshi to retaliation and the company to lawsuits.

- The forensic team’s findings gave the board proof, not just suspicion.

Forensic Accounting Team Enters – The Investigation Begins

Forensic accountants are detectives of numbers. They use laptops, special software, and an unshakable instinct for patterns. They detects fraud by digging deep into a company’s financial records to uncover hidden patterns, unusual transactions, and inconsistencies.

Forensic accounting detects fraud by combining ratio analysis, trend analysis, Benford’s Law, cash flow testing, journal entry reviews, data mining, and digital forensics. These techniques uncover hidden patterns, irregular transactions, and mismatched records—revealing when numbers don’t add up and exposing the truth behind financial deception.

1. Ratio Analysis – The Financial Health Check

They compared key financial ratios:

- Debt-to-Equity had spiked unusually fast.

- Inventory Turnover was too low despite high reported sales.

- Operating Cash Flow to Net Income was negative — meaning profits were “on paper,” not in reality.

Why it mattered: Healthy companies don’t show such mismatched trends without a reason.

2. Trend Analysis – Spotting Sudden Shifts

They plotted revenues, expenses, and debt over 12 months. Everything looked steady until the last quarter, when profits magically jumped while expenses stayed flat — another red flag.

Why it mattered: Fraud often shows up as sudden, unrealistic improvements.

3. Benford’s Law – Numbers Have a Natural Pattern

Using Benford’s Law, they checked the frequency of first digits in transaction amounts. In real life, numbers follow a predictable pattern (more 1’s than 9’s). The company’s books had unnatural spikes in certain digits, suggesting manipulation.

Why it mattered: Fake numbers often break natural statistical patterns.

4. Cash Flow Testing – Following the Money

The team traced actual bank deposits against reported sales. Many “sales” had no cash inflow at all — meaning they were fake entries just to inflate revenue.

5. Journal Entry Testing – Midnight Magic

They pulled all manual journal entries made outside working hours. Almost all suspicious entries were posted late at night, moving amounts between unrelated accounts to hide losses.

The Boardroom Showdown

The forensic findings were presented in a closed-door board meeting. The Independent Directors took the floor:

“We have a duty to our shareholders”

Management tried to brush it off — “a clerical error” — but the IDs demanded immediate action.

The Chain of Escalation

- Audit Committee → Board of Directors

- The board was informed in a closed-door meeting.

- The CFO, who had signed off the manipulated reports, was immediately suspended pending investigation.

- Board → External Auditors

- The external auditors were called in to review the last three years of financial statements.

- Several prior year profits were restated, bringing them closer to reality.

- Board → Regulators & Banks

- Since the fraud involved loans and investor funds, the matter was escalated to the Securities Regulator and bank lenders.

- This preemptive disclosure prevented legal penalties for delayed reporting.

How the Big Fall Was Averted

At the time the fraud was uncovered, the company was negotiating a large public bond issue.

If the fake profits had gone unchallenged:

- Investors would have poured money into a hollow business.

- When reality hit, the share price would have crashed overnight.

Because Sakshi and the forensic team acted fast:

- The bond issue was paused before launch.

- The company quietly restructured its debt and sold non-core assets to stabilize finances.

- The share price still dipped, but a controlled correction avoided a full-blown collapse.

A Fall That Never Happened

The ₹300 crore was stopped in time. Had it gone through, the company’s quarterly results would have shown inflated expenses, triggering a stock crash and shaking investor trust.

Instead, when the news broke, it was framed as a victory for corporate governance — “Fraud Averted by Early Action of Independent Directors.”

Investors responded with relief, not panic. The share price dipped briefly but recovered quickly.

Sakshi’s Quiet Triumph

Sakshi was quietly transferred to a secure role, her identity still protected. The lead Independent Director sent her a short note:

“Your courage saved thousands of investors. You may never get public credit, but you have our gratitude.”

The Lesson

Sakshi’s courage to act when she noticed irregularities proved that one alert person can save thousands from loss.

Her decision to quietly document evidence, write whistle blower complain,resulted in a chain of investigations & actions from audit committee to the forensic accounting team, to the Board, the external audit committee to regulators, banks & thus prevented a multi-crore fraud from wiping out employee livelihoods, investor wealth, and the company’s reputation.

Why the Forensic Accounting Team Was Crucial:

- They had the specialized skills to dig beyond surface numbers and uncover hidden manipulations.

- They connected financial clues like a puzzle, proving the fraud with evidence that could stand in court.

- They worked independently and fearlessly, ensuring no internal pressure could bury the truth.

- Their findings gave independent directors the confidence to act quickly before the fraud grew bigger

Key Takeaways:

- Early detection saves lives and livelihoods — delays can make recovery impossible.

- Documentation is power — facts and evidence speak louder than suspicion.

- Forensic accountants are allies — they turn whispers of doubt into proof of wrongdoing.

- Independent directors matter — they can push for transparency and protect whistleblowers.

- Silence protects fraud, not jobs — raising red flags is a responsibility, not a risk.

Sakshi’s story is proof: when numbers tell lies, speaking up tells the truth.

Final Thoughts

Forensic accounting isn’t just about catching fraudsters — it’s about preventing the damage before it happens.

Whether you’re an investor, a board member, or a regulator, adopting a forensic mindset can protect wealth, jobs, and trust.

Forensic accounting isn’t just about numbers — it’s about saving trust before it’s too late.

Fraud doesn’t arrive with warning bells. It slips in quietly, hiding behind clever entries and polished reports. And when it’s finally exposed, it’s not just money that’s gone — it’s jobs, dreams, and people’s life savings.

A strong forensic team is the alarm that can stop a collapse before it begins. They don’t just catch the guilty; they protect the innocent.

Because when numbers lie… they’re the ones who make them tell the truth.

Call to Action

⚠️ When Fraud Strikes, Everyone Bleeds.

Fraud is not just a corporate scandal—it’s a human disaster.

- Investors lose their lifetime savings.

- Employees lose jobs and future security.

- Suppliers & partners are left unpaid.

- Customers lose trust in the brand.

- Communities suffer from economic ripple effects.

If you see red flags — don’t stay silent. Speak up through whistleblower channels.

If you’re an investor — ask the hard questions, demand transparency, and insist on a strong forensic accounting team.

If you’re in leadership — build or engage with expert forensic accountants to detect trouble before it becomes a disaster.

Fraud thrives in silence. Truth wins when we act — with the right team on our side.

One ignored red flag can destroy decades of work.

Speak up. Raise the alarm. Do not let fear of retaliation silence you.

Your courage today can save thousands from loss tomorrow.

Read our blogs on Corporate Governance here.

The Council of the Institute of Chartered Accountants of India, recognizing the need for Forensic Accounting and Fraud Detection, has decided to launch this Certificate Course on Forensic Accounting and Fraud Detection.Check details here.